7 Execution Gaps Every Sales Leader Struggles With — and How to Solve Them

As a sales leader, you want to create strong teams that consistently hit their quota. But let’s be honest: You also know that if YOU were in every single deal, you’d close a significantly larger percentage of your organization’s opportunities. Simply because you have more experience and know the sales playbook inside out.

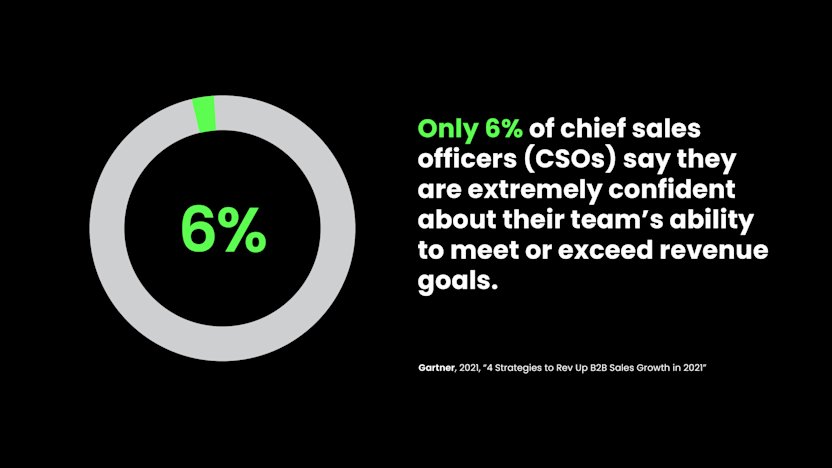

The reality is, you CAN’T be in every deal. So you have to trust your troops in the field, who — weighed down by gaps in sales execution — struggle to perform at their best. According to CSO Insights, only 53% of sales representatives are meeting or exceeding their quotas. (How many other departments could get away with a 50/50 success rate?)

While your current analytics tools do very little to close — or even show — your execution gaps, you can get rid of them once and for all with the right tools.

1) You have no way to accurately identify pipeline gaps

Your tech is great at reporting on outcomes, but it’s not doing anything to help you identify where the pipeline gaps are. That’s left to your managers’ intuition at best — it’s often rushed, and certainly not data-driven. And even when they’re correct, thanks to their hard-won experience — your pipe gen efforts are often not aligned to where you really need leads.

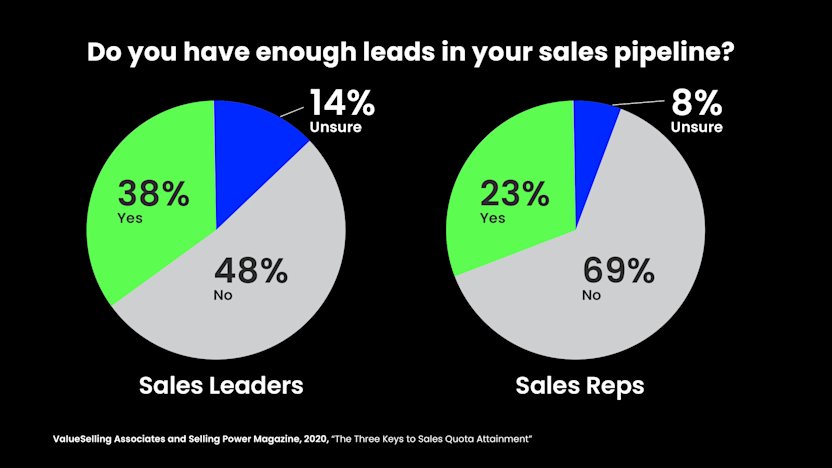

The disconnect between gut feeling and reality can also be put in numbers. In a 2020 survey conducted by ValueSelling Associates and the Selling Power Magazine, 38% of sales leaders believed their reps had enough pipeline to meet quota, while only 23% of salespeople answered the same questions with “Yes”.

Solution: Base your pipeline generation on data, not on intuition

A mindset shift can help. You might say: “I see exactly where my opportunities are in the pipeline.” The problem is: Most CRM dashboards on the market — although claiming to provide real-time information on current opportunities — really only give you a snapshot in time. But in order to understand where your opportunities are going to land, you have to understand their journey: Which lead hasn’t been touched in weeks or even months? which account doesn’t have an opportunity yet? How have similar opportunities progressed over time? Advanced sales tools that include tech like Machine Learning, Process Mining, and AI deliver the insights you really need: They analyze your current opportunities and show you at a glance which of your sales reps have the largest pipeline gaps.

The best tools deploy predictive analytics: They surface accounts that don’t have an opportunity yet and prioritize these accounts based on past process behaviors of similar accounts and recent engagement (using Process Mining & ML algorithms). Instead of fishing in the dark, your GTM teams can now drive targeted campaigns to create new opportunities.

2) You can’t accurately assess pipeline quality

Next up, your pipeline quality is iffy at best, for similar reasons. Your reps’s assumptions when it comes to probability to close can be hit and miss — or worse, they are actively trying to cover up when things go wrong (like creating a clone of an old opportunity so it'll look like it hasn't been in the pipeline for that long or moving the close date to 12 months from now).

On top of that, your dashboards don’t help you much to understand which opportunities might be shaky and require more prep work from your sales reps (or coaching from your sales managers). After all: If you see that you have $75M in the pipeline when your target is $25M, why would you worry?

Solution: Get a 360-degree, real-time view of your pipeline

Transition from an outcome-based reporting towards a 360-degree, real-time view of your pipeline. Leverage historical data to assess the strength of current opportunities (with the help of Process Mining) and predict their outcomes. See which opportunities are really worth focusing your sales reps’ time and effort to hit your targets, instead of just measuring them by “activity”. Then, automatically engage the right resources in the right opportunities: Has bringing in an executive sponsor to an opportunity helped with similar deals? Which sales rep with an impressive closing rate in that specific industry can provide helpful best practices?

3) Your CRM hygiene leaves much to be desired

Whether you’re using swish-looking dashboards or still working with old-school excel reports, let’s face it — you don’t really trust your reports, because you know your CRM data quality is horrible.

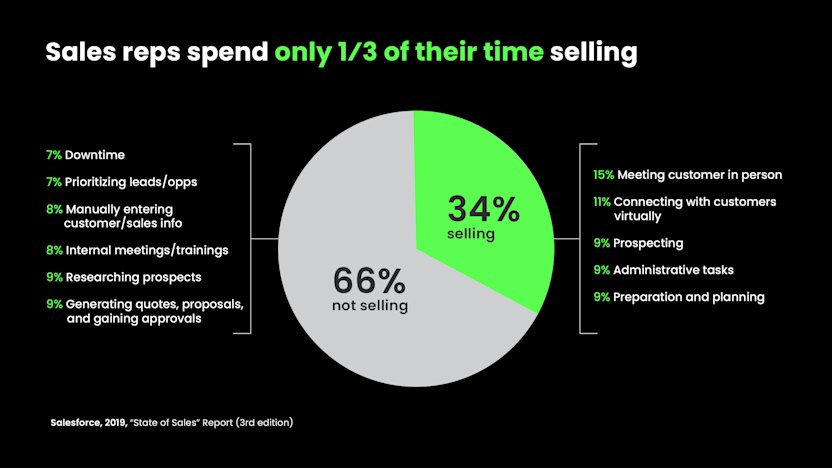

According to Salesforce’s 2019 State of Sales Report, “in 2018, duties like data entry and paperwork filled so many hours that reps only spent one-third of their time actually selling.” Logging activities and inputting sales data and customer notes were two of the top 5 menial tasks, surveyed reps said they spend too much time on.

But how can you make informed decisions when your data quality is bad? The problem: Until your sales reps start seeing CRM hygiene as something that benefits them rather than a waste of time, it’s going to be hard to change that.

Solution: Help your reps to see the value — and automate what can be automated

The pain of your sales’ reps and account executives’ existence is to keep the CRM up-to-date. After all, would you enjoy filling in dozens of fields every day for hundreds of opportunities? An easy fix is automated data entry. Let automation fill in the fields that don’t need human supervision (like meeting scheduling, quote generation, meeting follow-ups, rep assignments, or lead scoring).

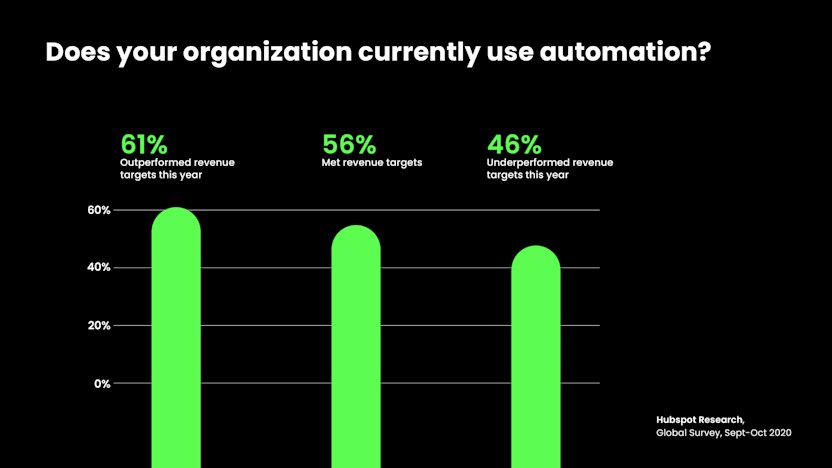

According to a HubSpot Global Survey in 2020, sales organizations who are exceeding revenue targets use automation as a part of their sales process, while respondents who missed their targets are less likely to have adopted automation.

Advanced analytic tools can proactively identify data hygiene violations on a granular level and send immediate alerts to violators to build accountability. Add intelligent next-best-actions on top of that, and you can guide your team through what they have to do next for the opportunities that really matter.

That way, you can kill two birds with one stone: You get the data quality you need to be confident about your forecast — and give your sales reps the time to do what they do best, sell.

4) Your close rates are low

“Every customer needs your attention as if they were your only ones”, the saying goes. Sadly, reality looks different. Although your sales teams are without a doubt weighing in all their talent and expertise to close deals, they just can’t know which sales step is best for which customer in which stage of the cycle. And that’s no surprise, as best practices to improve close rates are mostly hidden in the depths of your CRM.

At the same time, you don’t understand discrepancies in close rates, because you lack the overview.

Solution: Get the right resources for the right opportunities

Sales reps ultimately want to sell more, so give them the data that will help them do that. The best tools can support both ends of the hierarchy: They can give you as a sales leader data-driven insights into low close rates across specific sales teams, products, and territories. And they can give salespeople insights, for example, into individual performance against targets, and recommend specific actions to increase the close rate for each opportunity. That can be pulling in a specific partner to build executive alignment or giving your opportunity an update on the next steps. If you can quantify the impact of these actions on your close rates, even better.

5) Deals get stuck

Longer B2B sales cycles usually equal more opportunities for sales deals to get stuck (or die) in the process. And complex, intransparent internal processes and procedures don’t make winning deals any easier.

The problem: You have no visibility into which opportunities stay too long in one stage — and why. As a result, you don’t know which deals you should really focus your attention on and which ones you better “retire”. I know you probably have two to three deals in mind for which your sales reps should make another push to move them to the next stage. But for the majority of opportunities, you have to trust your sales team’s judgement and individual engagement.

Solution: Know the journey of each opportunity

Advanced throughput time analysis can give you a clear understanding of key factors that extend or accelerate your sales cycle, or even make it unlikely to close the deal. Are your negotiations not leading to quote creation? Has your opportunity been in an early stage for more than 60 days? Is your opportunity looking into competitors and hesitating to go forward with you?

Smart alerts can inform your AEs or sales reps when a deal is stuck. The best tools on the market also determine next best actions, such as connecting deals to the best performing teams to seal the deal, setting up a customer reference call for an opportunity that’s one the fence, or — if stage durations indicate a low chance of winning — close a deal and reprioritize resources.

6) Discounts weaken your revenue

In B2B Sales, it’s common for buyers to seek discounts on your products or service solutions. After all, who doesn’t like to get the best possible deal, right? And of course, you need to give your sales teams some leeway to close the “tougher” deals. But when the value of an opportunity changes multiple times (for example when they consistently lose 20% in each negotiation round), it’s hard to trust your current pipeline. On top of that, you usually can’t see what drives those changes in deal value, making it difficult to reduce discounting.

Solution: Pinpoint the activities that make your deals lose value

To avoid balancing out discounts, traditional methods — like discouraging discounts through tedious approval workflows or training your people in better showcasing your solution’s value — might come to mind. But if you want your forecasting to really be on the safe side, you need to dive into the data.

Data analytics can provide visibility into which sales activities significantly influence opportunity amounts. Is it because the pain point discovery wasn’t convincing enough early in the sales cycle? Is it a specific product that gets discounted over and over again and needs to be repositioned? Or does one of your sales reps just tend to give higher discounts than his or her peers? The best tools can quantify the impact of these activities and recommend actions to improve deal values, for example connecting with a sales rep who has maintained deal value high on similar use cases.

7) The bias in your forecast keeps you from hitting your targets

As a CRO, you have to be confident about your forecast, even though many factors play against you: Your qualitative forecasts are based on static reports, the subjective assessment of your managers, and rarely factor in historical performance. In short: There is all sorts of mixed incentives and human bias involved. Your sales reps might hold back certain details in their 1:1s to seal the deal themselves for example. Your Sales RVPs might massage some of their less-engaged opportunities or simply overestimate their probability to close.

Especially in large B2B organizations, your hierarchic forecasting has so many levels that valuable intel on your opportunities gets completely lost along the way. The result: It’s hard for you to detect potential risks early enough to actually do something about them, and there’s little to no visibility into forecast deviations.

And even if you’re already using a more data-driven approach, your current tools don’t take the individual opportunity’s journey into account. They tend to simply aggregate your historic forecast data to predict how many deals you would close based on the same conditions. But every opportunity is different, and therefore every sales cycle is different. Historical performance can be a guide post, sure, but shouldn’t be your only one to stay on track.

Solution: Back up your sales forecast with data, not just wishful thinking

Don’t get me wrong: Forecasting calls are still valid. But you can augment your qualitative forecasting with data analysis and artificial intelligence. Some tools on the market already automate most of the legwork, generating the necessary reports to pull historical forecast data in just a few clicks.

The very best tools go even further: They rely on smart algorithms and engagement data to predict the next quarter’s revenue with a higher degree of accuracy. Combining technologies like Process Mining, AI, and Machine Learning, they analyze every single opportunity based on demographics, what journey it’s been on, what actions have been taken that lower or raise the probability of them to close.

By triangulating your deal-specificforecast with your past forecast accuracy and your subordinate’s qualitative forecast, these tools help you to automatically identify inconsistencies in your forecast, surface potential risks in deals that are likely to close, and take the right action thanks tonext-best-action recommendations. That way, you can allocate your resources in descending order of opportunity size and probability of closing.

This is when forecasting transitions from “art” to real data-driven science.

Conclusion: The next big thing in sales tech

In this article, I’ve been mainly focusing on the tech stack modern Sales leaders will need to close their execution gaps and steer their ship toward success. As Gartner predicts in their The Future of Sales in 2025: A Gartner Trend Insight Report: “Very soon, every decision that sellers make, every action they take and every insight they gain about the health of their deals will be driven by data and analytics.”

But it would be too easy to say that technology alone will solve all your problems.

To face the seismic economical changes and adapt to new emerging customer behaviors we’ve seen in 2020, Sales leaders need to equip their organizations with the right knowledge, the right processes, the right skills, and the right technology mix. On the sales ops side, all of this ideally converges into one intelligent sales execution system that automatically enhances every deal by delivering customized next best actions for every opportunity. The result: data-driven sales execution that helps you win more, faster, and smarter.

Or, as Gartner puts it:

I hope this blog serves as an inspiration to explore new growth strategies and tactics to drive a fully data-driven sales organization — and as an incentive to closely follow the evolution of sales tech.

Want to know more about how tech can resolve execution gaps in Sales? Check out the “The Future of Sales in 2025: A Gartner Trend Insight Report”.