The Digital Transformation Opportunity Banking and Finance Are Missing Out On

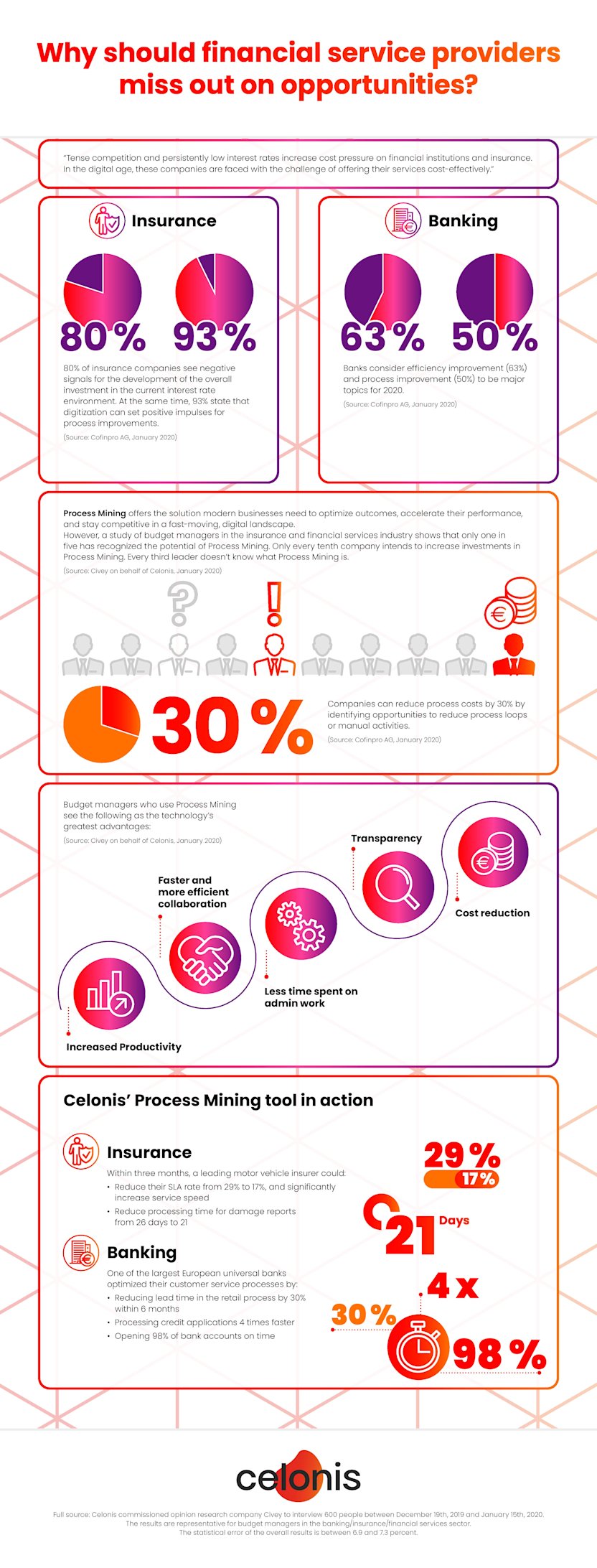

Digital Transformation means fewer silos, more collaboration, getting closer to your customers and often a better bottom line. For years, companies across all kinds of industries have been reinventing themselves by embracing Big Data analytics, cloud computing, and mobile. Faced with global competitive pressure and increasing customer expectations, financial service providers and insurance companies can’t miss out on the opportunities of digital transformation. But the industry is lagging behind. That’s the conclusion of a most recent survey conducted as part of an EY Innovalue Insurance Roundtable. Although 93% of insurers state that digitization can provide positive impulses for process improvements, around 40% of them have implemented insufficient digital projects in the past year or not at all.

If companies want to be in the top echelon of the finance and insurance industry in the future, they have to act fast. The competition never sleeps. Insurers and banks need to:

regain an overview of their sales processes,

align the processes even more closely with the customer,

optimize those processes to be more efficient, in order to

generate the greatest possible business outcome.

Few have recognized the potential of Process Mining

This is where Process Mining comes in. By creating an X-ray of business operations, the technology provides the much-needed insights to eliminate bottlenecks, drive transformation and achieve better business results. Only when business leaders understand their process inefficiencies, they can invest in the right digitization activities.

But change comes slowly. A study commissioned by Celonis shows that only a few financial service providers and insurance companies have so far exploited the potential of Process Mining.

Only one in five budget managers in the financial services sector knows about the benefits of Process Mining.

Only every tenth company intends to increase investments in Process Mining.

Every third leader doesn’t know what Process Mining is.

Thus, many companies miss the chance to capture, analyze and optimize business processes with the help of this innovative technology.

Because leaders don’t know about this powerful technology, they miss out on opportunities to stay ahead of the competition, which is essential in a market that’s characterized by increasing cost pressure and competition.

How Process Mining can help the Financial Services Industry

Process Mining uses data generated from digital business processes, which are recorded in so-called event logs. These are saved by default, for example when contracts are concluded or service requests are processed. Celonis uses this database to visualize business processes in real-time. In the financial services industry, Process Mining can be applied in multiple business areas, including claims management, premium collection, customer service management or internal audit.

With Process Mining, however, insurers and financial service providers aren’t only able to make individual parts of their business more efficient. They also receive a holistic overview and starting points for a comprehensive digital transformation across company divisions - with the clear goal of improving the business results throughout the entire company.

Based on machine learning and artificial intelligence, Process Mining also provides next-best-action recommendations to eliminate process inefficiencies - for example, in internal procedures in the context of claims settlement. The Celonis Action Engine, an AI-powered process assistant that constantly analyzes data, helps prioritize the processing of cases.

Process Mining also helps to continuously monitor improved processes in real-time. This enables companies to achieve optimal results, such as fast processing of customer inquiries or prioritized payment of invoices. This has a positive impact further along the value chain: Not only are processes more efficient, but employees - and customers - are happier. In times of high customer demands, Process Mining is an important basis for long-term success.

Benefits of Process Mining at a glance

The time for the financial services industry has come to tackle digitization in a more systematic way. Isolated from the day-to-day business and created on the drawing board, transformation initiatives only create new friction. And friction is the last thing companies need when the stakes are high.

Business leaders need to optimize business processes to drive successful digital transformation initiatives in the long term. For banks, insurance companies, and other financial service providers looking to remain competitive in a fast-moving and complex market, Process Mining offers the following key advantages:

The technology boosts efficiency and allows companies to create fast added value for customers.

The data-based approach reduces risks while increasing control.

Since weak points and cost drivers are identified immediately, bottlenecks can be avoided.

The result: Optimized, frictionless processes that lead to better business outcomes and well-oiled digital transformation initiatives.