How assortment strategy processes are winning the day for retailers

Retail assortment strategy is experiencing a renaissance as retailers couple art, science and process excellence to win over consumers.

Companies such as Target, Gap and Macy's have all talked about the strategy behind their assortment management and how they are navigating everything from inventory levels to port delays to forecasting sell-through and out-of-stock. The trick is to offer an assortment of goods that can maximize customer value as well as profits.

When it comes to assortment, retailers can go deep with a vast array of goods, wide by covering every category, localized or mass market. Assortment optimization refers to trading off breadth and depth to optimize value. Toss in private label goods and the assortment game gets complicated. One thing is clear, retailers will need process transformation to remove inefficiencies needed to balance assortment and prices in an inflationary shopping environment.

Here's a quick tour of retail assortment strategies:

The Gap CEO Sonia Syngal said on the company's fourth quarter earnings call:

We buy a lot of units to distribute to 2,800 stores. And so, what we're doing is applying more and more advanced analytics and AI to optimize our distribution from our distribution centers to our stores. We get better with more even sell-through and less markdowns whether that's size optimization or assortment optimization for seasonality or whether it's just replenishing sell-throughs. We're expecting some nice benefits on that front as well as on forecasting — fashion forecasting. We have a multiyear plan on inventory management transformation and the big wins this year will be around allocation.

Macy's CEO Jeff Gennette said on the company's fourth quarter earnings call:

Through our data-driven merchandising approach and our team's agility and creativity, we successfully navigated supply chain challenges, ensuring we had a strong assortment for the holiday season. We placed bets on categories like fragrances, fine jewelry, home decor, men's outerwear, toys, sleepwear and watches, which all performed well in the quarter.

Gennette added that assortment is co-mingled with inventory and supply chain transformation too.

Target's Christina Hennington, Executive Vice President and Chief Growth Officer, said on the company's fourth quarter earnings conference call:

Through our careful balance of exclusive owned brands and industry-leading national brands, Target differentiates by curating a unique assortment, driving preference in a crowded retail landscape.

She added that Target's assortment is also about driving customer value and relationships. "We are able to develop and produce products at an incredible quality and value, always a focus for our guests, but never more so than in an inflationary environment," said Hennington. "Our guests tell us that affordability begins with price, but also includes proximity, accessibility and assortment choices that satisfy any budget."

It's clear that retail executives believe the key to their success is assortment. Behind those assortment choices are process excellence and data that connects execution with inventory management, supply chain transformation and continuous improvement

Accenture recently noted in a research paper that "one-size-fits-all no longer works - retailers need to strike the right balance between hyper-localized and common assortments." To find that balance, Accenture argued that retailers need to consider context, the company’s data foundation as well as the full integration of analytical results into decisions.

In a report, Accenture noted:

Consumer-centric assortments are THE key lever to sustainably grow net sales, profitability, and increase loyalty. Consequently, assortment optimization is experiencing a renaissance. The most beaten truism of retail – the right product at the right time and the right place with the right price – proves its applicability once again.

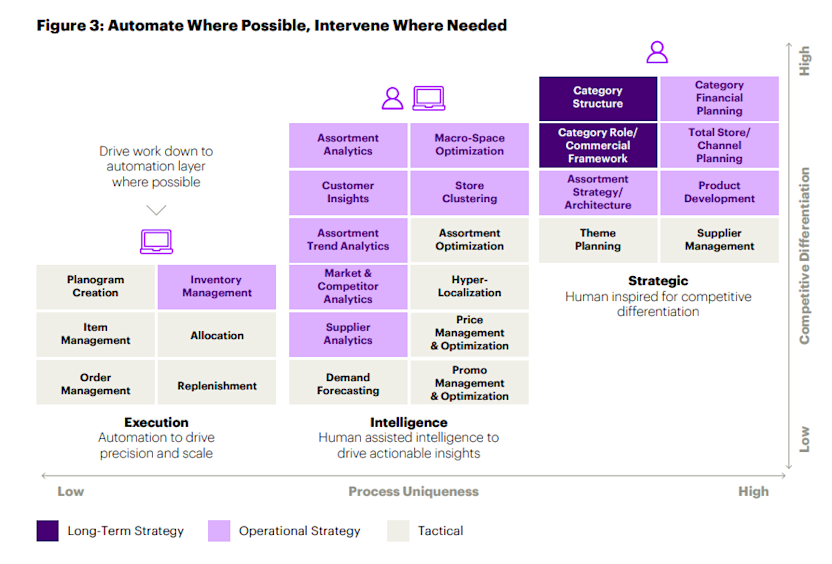

Behind those assortment decisions is execution management and process mining. Through process optimization, retailers can decide what to automate and how to improve operations based on real-world data.

According to Accenture, "process uniqueness" is what wins the day. A prime example would be Target's omnichannel approach coupled with delivery. Here's a look at Accenture's assortment meets automation progression (image source: Accenture):