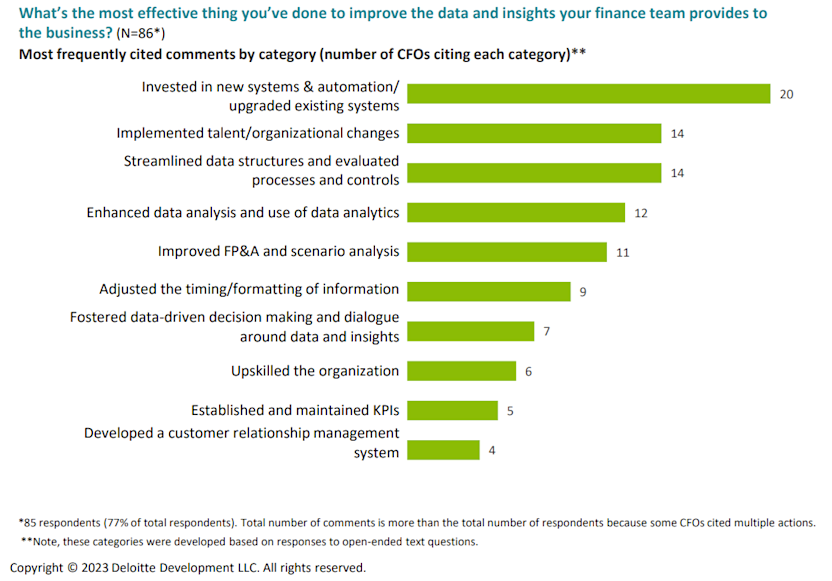

CFOs investing to improve systems, data insights, process excellence, says survey

More than half of Chief Financial Officers said that legacy technology and systems, inadequate process data and talent are the biggest roadblocks to gleaning business insights, according to Deloitte's latest CFO Signals survey.

Steve Gallucci, national managing partner, U.S. CFO Program, Deloitte LLP, and global leader, Deloitte Touche Tohmatsu Limited, said:

"CFOs pointed to inadequate technologies/systems, immature capabilities, and lack of experienced talent each as their greatest roadblocks in driving data to insights. The majority of surveyed CFOs have taken actions to address those challenges, such as investing in new systems and automation and upgrading existing systems, implementing talent/organizational changes, and streamlining data structures and evaluating processes and controls."

The focus on insights, automation and data-driven decisions comes as 93% of CFOs are planning for a mild recession, according to Deloitte's CFO Signals survey, based on 111 respondents. Previous data from Deloitte as well as Gartner indicate that CFOs are increasingly focused on automation, analytics and process excellence.

Deloitte's latest survey focused on data and insights. CFOs are looking for multiple improvements to decision making in 2023 and 2024. Core priorities include:

Artificial intelligence and automation.

Improved forecasting, scenario planning and KPI consistency.

Build analytics to get timely and quality insights from data.

And act with speed, agility and transparency.

To reach those goals, CFOs have been investing in new systems, reorganizing and streamlining data structures, processes and controls.

CFOs are playing a central role in driving operations beyond finance such as sales, supply chain and risk management. The list of strategic priorities for CFOs is long:

Manage & optimize financial health; track key balance sheet and P&L metrics.

Manage capital structure; raise/pay off debt level in optimal ways, manage equity in accordance with company goals.

Improve DSO; accelerate cash collections (Accounts Receivable), optimize Accounts Payable.

Improve profitability; support & drive GTM organization towards growth, drive cost reduction across the org.

Optimize Working Capital; support & drive supply chain org towards lean procurement & inventory processes.

Ensure checks & controls exist for regulatory compliance, accurate financial reporting.

Drive strategic transformation initiatives for improved efficiency/accuracy.

Manage systems & software landscape for minimum friction

Streamline reporting for efficiency (low touch) & accuracy.

Streamline all finance processes for cost reduction.

These strategic CFO priorities also ultimately measured by a bevy of KPIs including operating cash flow, working capital, inventory turns and cash conversion to name a few. To improve those KPIs, CFOs are looking to revamp transaction processing functions such as procure to pay (P2P) and order to cash (O2C)." At Celosphere 2022, Celonis customers also highlighted use cases for Accounts Payable, Accounts Receivable and Procurement as well.

More: