Process mining, optimization 2023: Here's what analysts are predicting

Corporations will need to adapt to macro-economic challenges and optimize processes in 2023 as process mining demand accelerates.

Here's a look at what analysts say about process mining and execution management for 2023.

Ray Wang, Principal, Constellation Research

Process mining is accelerating due to a confluence of crises that will require more efficiency to hold the line on operating margins. You know the risks already, but here's the short version:

Inflation.

Interest rates.

Supply chain risks.

Wars and conflicts.

These issues are magnifying supply chain inefficiencies.

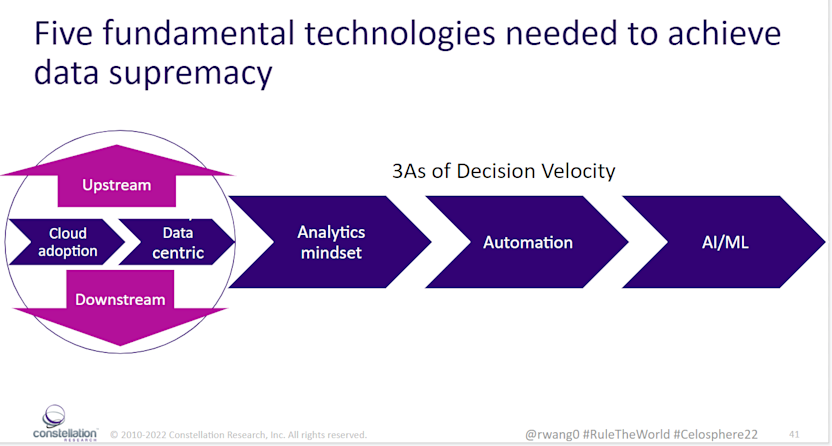

Wang said that companies betting solely on cost cutting and price increases will fall short of expectations. As a result, every company will become a technology company focused on AI, automation and analytics with cloud computing as an enabler.

Key takeaways:

Optimizing processes will be important for efficiency and innovation as execution gaps are visualized and employee capacity is maximized.

Process optimization will need to fuel revenue and growth, operational efficiency, strategic differentiation, regulatory compliance and brand lift.

Process leaders need to focus on mass personalization, contextual relevancy to customers and partners and identifying the next best move.

Automation will be critical for data supremacy and decision velocity.

Ultimately, process leaders will move to an autonomous enterprise model built on trust in data, intelligence and human judgement as well as AI driven systems.

Reetika Fleming, HFS Research analyst

Given the uncertain economic environment and need to drive growth, process intelligence has become the hottest emerging technology.

Enterprises, however, need to beware of the hype and focus on best practices to implement process intelligence and digital transformation.

Key takeaways from Fleming include:

Digital transformation has become table stakes and necessary for survival. Enterprises need to find new sources of value.

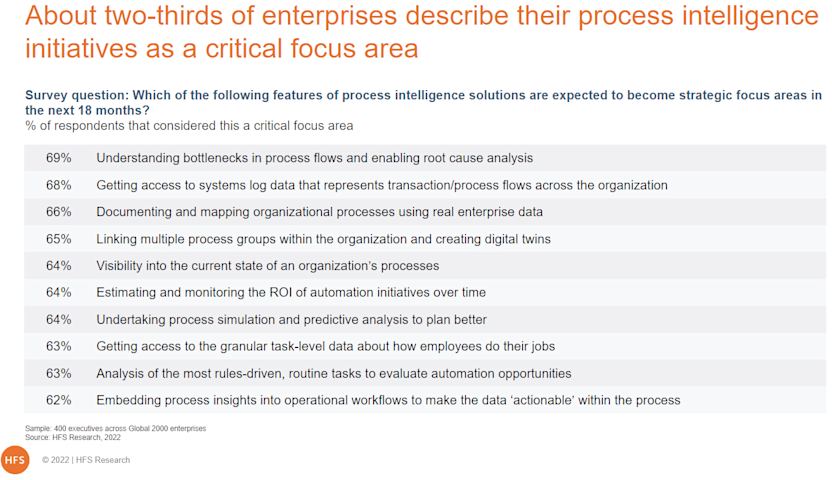

Process and task mining are already in use to improve process excellence and drive productivity. Removing bottlenecks, productivity, working capital optimization and automation are all key use cases, according to HFS Research surveys.

Finance and IT are departments demanding more process intelligence.

Most enterprises expect to realize value from process intelligence within two years courtesy of Centers of Excellence (CoEs) and self-serve capabilities.

Enterprises acknowledge early implementation challenges but see significant benefits.

Adoption of process intelligence has plenty of room to grow since 23% of engagements are fully scaled up.

Process intelligence teams will need technical and non-technical skillsets and diversity of thought. Aside from the data heavy lifting and analytics, remember communication and storytelling is also key.

Harpeet Makan, Practice Director, Service Optimization Technology at Everest Group

Makan also cited the challenges affecting enterprises and noted that companies need to shift to being digital first but fast rising expectations, cost pressure, talent shortages and the need to manage risk.

Makan said:

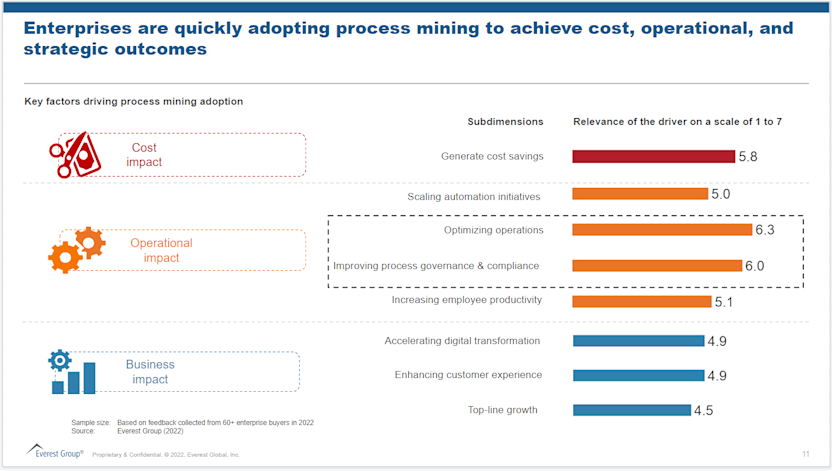

Lack of process visibility is the No. 1 challenge facing business followed by a complex system landscape.

Process mining demand is surging because it drives transformation built on insights and automation. Ultimately, the goal is process orchestration.

Cost savings is a top priority, but optimizing operations is also emerging as a big goal.

Scaling process mining becomes challenging largely due to data quality and limited visibility of interconnected processes.

Enterprises should focus on guided data clean up tools to start preparing for process intelligence.

Question-based exploration and packaged process mining solutions focused on industry use cases will accelerate adoption.

Intuitive process discovery approaches for business users will accelerate process transformation.