The Efficiency Imperative in 2023: Driving Value in Uncertain Times

Several factors are changing the way organizations will plan and execute automation projects in 2023, including economic uncertainty, the need for automation technologies to seamlessly work together to deliver the broadest possible automation and process improvement benefits, as well as the need to tie these efforts together to deliver provable business benefits.

In a nutshell, organizations increasingly want to accurately predict the business value of automation opportunities before automation investments are made. That means approval to fund an automation project will have a much greater dependency on automation planning that combines identifying automation opportunities with business value metrics. Once automation projects begin, mirroring metrics will continuously measure the business value delivered as improvements move into production.

Also see: IDC Predictions and the Efficiency Imperative in 2023: How to Drive Value in Uncertain Times | IDC's 2023 outlook: Process mining evolves to business value engineering

While the market has been moving in this direction gradually, IDC is seeing greater interest in technology alignment with business value — especially as organizations prepare for a recession. Seventy-two percent of respondents to a recent IDC worldwide survey expect a recession in 2023. Respondents also anticipate a more conservative approach to IT spending.

Forty percent believe IT budgets will be flat or increase slightly, while 35% believe budgets will be reduced only in specific areas, while 15% expect IT budgets to be reduced across the board.

The past several years have seen automation investments grow in double digits. IDC expects that growth to continue, but at a modestly softer rate. Should the economy slow, priorities will naturally focus more on ways automation can concretely improve financial performance by adding cash to the balance sheet and improving operating profits without degrading customer satisfaction.

Automation Priorities in 2023

According to IDC's September 2022 Future Enterprise Resiliency and Spending Survey, the top three automation priorities in 2023 are:

Lowering operating costs (42% of respondents)

Greater efficiency (41%)

Improving customer satisfaction (41%)

In the same survey, the top business areas to be prioritized for automation are:

Supply chain (46%)

Customer care (40%)

Finance (34%)

Platforms Must Now Support Seamless End-to-End Automation

Enterprises historically have had to select diverse automation technologies from different vendors to implement end-to-end automation. The biggest challenge to this approach is achieving a seamless connection of the technologies, but it’s also a top priority of vendors, according to IDC research.

Automation platform vendors are beginning to supplement core technology-specific automation development capabilities with a technology-agnostic orchestration layer used to advance work through a process regardless of the underlying technology. The combination of multiple types of automation and an orchestration environment design and execution will substantially solve the challenge of combining diverse automation technologies to broaden automation's potential in an enterprise.

Ensuring that the automation-led process improvement works well will be accompanied by a need for continuous collection of data from these processes to monitor, notify, and solve problems.

Measuring the Business Value of Automation

The difficulty organizations have with building metrics that tie automation improvements to financial outcomes has likewise been a challenge. Process mining and task mining are two methods of tackling this challenge. Process mining looks at a business process while task mining identifies how workers perform the actual work – or tasks – within a larger business process.

By collecting event logs from applications, process mining produces documentation about how a business process works in production, producing a statistical analysis of process efficiency. Task mining documents how manual work is performed by recording workers performing the same tasks, likewise producing a statistical analysis that creates a score for whether the task is a good candidate for automation.

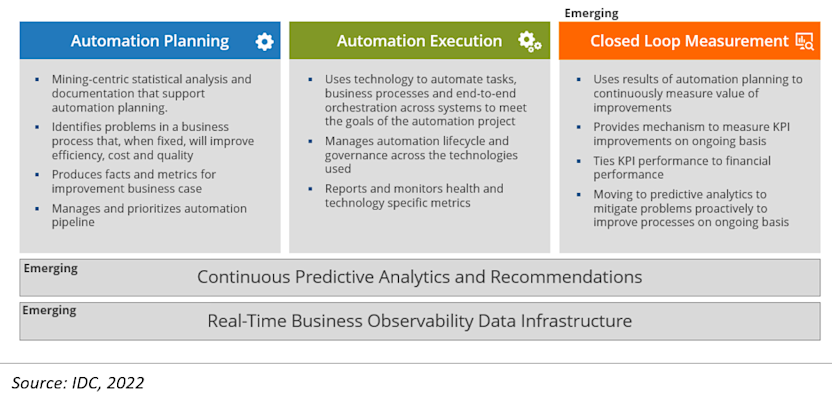

Both technologies provide metrics that can be used in an automation business case that includes recommendations for improvement, along with the metrics that can be achieved through improvement. The business value metrics used in planning then need to be applied upon execution to close the loop to ensure that business value of the planned investment is fully realized. The following figure describes this process, with closed loop measurement an emerging area:

With closed loop measurement, there is also a shift to continuously collect data for continuous improvement. As more processes are improved and linked together via data, there is a greater opportunity to identify root causes to problems upstream that can often be fixed to prevent downstream problems, especially problems that impact a customer's experience.

Process Mining Evolves to Business Value Engineering

Business value engineering is a term used by IDC to describe a discipline and software portfolio aimed at improving the focus, quality of planning, and execution of automation and process improvement projects to ensure they deliver tangible value to the organization as well as continuously increase the overall value by operating more proactively to solve problems.

There are other efforts similar to business value engineering. FinOps focuses on cloud spending accountability while value stream management is used to align development with stakeholder value.

Over time, these efforts will shift technology decision making to a much greater emphasis on planning, fact-based decision making and accountability, and a greater understanding of how technology investments translate to financial performance.