Large enterprises look to productivity, efficiency gains to manage through inflation

Turbulent times often lead to efficiency gains, and the recent round of earnings reports from large enterprises show that productivity is a big a priority since companies can no longer pass along costs easily to customers.

One of the big takeaways from Celonis World Tour 2022 was that enterprises will have to become more efficient via process mining, execution management and automation. "There are decades when nothing happens and then there are weeks when decades happen. If you look at the macro picture we are in those kinds of weeks," said Alex Rinke, Celonis co-Founder and co-CEO. Right on cue, CEOs are highlighting the need to be more efficient and adopt a continual improvement mindset on earnings conference calls.

According to FactSet Research, nine sectors in S&P 500 are seeing net profit margins declines in the second quarter compared to the same quarter a year ago. Four sectors are reporting net profit margins in the second quarter that are below their 5-year averages, according to FactSet Research, led by consumer discretionary companies. So far, 62% of S&P 500 companies issuing third quarter guidance have cut their earnings outlooks.

The S&P estimated earnings growth for 2023 is now 8.4%, according to I/B/E/S data from Refinitiv. That growth rate is down from 9.8% expected on April 1.

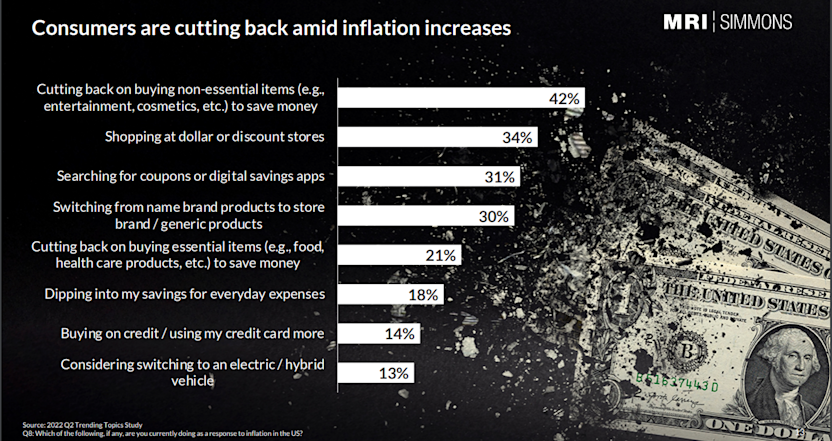

In other words, the squeeze is on enterprises as consumers alter their behavior to deal with inflation due to supply chain disruptions and other factors. Vivek Sankaran, CEO of Albertsons Companies, said "the consumer is clearly trading down" often in to the grocery chain's private label brands. Consumers are becoming more value conscious as well as prioritizing purchases.

A recent survey from research firm MRI Simmons highlights how consumers are cutting back amid inflation increases. The firm found that 42% of consumers are cutting back on non-essential items with 34% shopping at dollar or discount stories. Here's a look at the findings:

For many leaders, a continuous improvement mindset, deployed by Eurowings and ABB, will be needed to cope with macroeconomic uncertainty. Kraft Heinz CFO Andre Maciel explained how the food and beverage giant is leveraging this mindset on the company's second quarter conference call.

"Our teams are unlocking efficiencies with a continuous improvement mindset using levers such as value engineering and waste reduction to lower costs. We expect to free up at least $400 million in gross efficiencies this year and are well on our way to at least $2 billion by 2024," said Maciel.

Colgate-Palmolive CEO Noel Wallace said productivity will be a key way to cope with cost increases.

"As we enter the back half, we are just beginning to see early benefits from our 2022 global productivity initiative. Over the next 18 months, this program will help drive operating leverage. But we are still dealing with a very difficult cost environment. We now expect $1.3 billion in raw material and packaging inflation with higher logistics costs as well."

Jon Moeller, CEO of The Procter & Gamble Company, said on the company's second quarter conference call that his company will strengthen its execution to ensure supply, improve capacity, boost agility and cost efficiency and build resiliency.

"We remain committed to driving productivity improvements to fund growth investments, mitigate input cost challenges and to maintain balanced top and bottom line growth," said Moeller. "We've developed a productivity muscle that helps address some of the challenges we face. We remain fully committed to cost and cash productivity in all facets of our business, up and down the income statement and across the balance sheet in each business and corporately. Productivity improvement is a necessity to drive balanced top and bottom line growth and strong cash generation."